Banking designed for your business

Lili empowers your business with the banking features you need, while eliminating the hidden fees you don’t.

Banking services are provided Sunrise Banks, N.A., Member FDIC

with seamless integrations

Which of the following are most important to you?

No Minimum

Balance

Business Debit

Card

No Hidden

Fees

Multi-User

Access

Early Access to Payments5

Savings with 3.00% APY3

Unlock the potential to impact some of your D&B business scores

By connecting your Lili account with D&B Credit Insights, you unlock the potential to impact some of your scores.*

*By integrating your Lili Business Bank Account through the D&B Credit Insights banking integration feature, there may be potential for you to positively impact your Delinquency and Failure Scores. Dun & Bradstreet requires a minimum of six months of business banking transaction history to be able to potentially impact these scores.

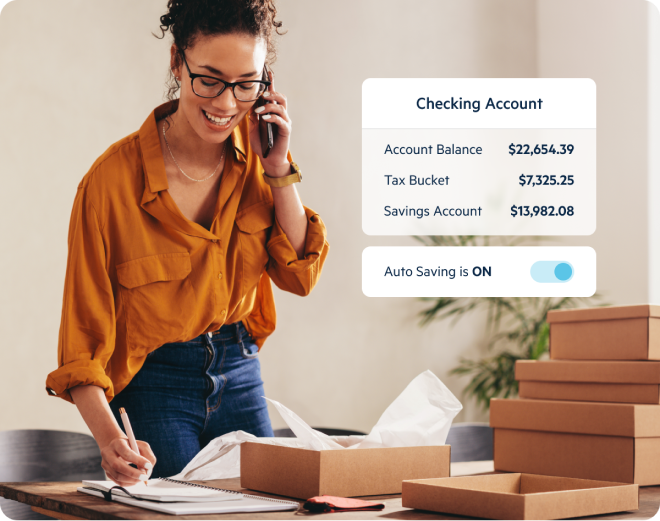

Business Banking

A business checking account that you open in minutes, so you can focus on what’s next.

No hidden fees, no overdraft fees4, and no minimum deposit or balance required. Seamlessly send and receive money using Standard and Express ACH, or by integrating payment apps or external bank accounts. Receive domestic wire transfers fee-free8 and without limits on the amount or number of transfers. And grow your balance with a savings account that earns you 3.00% Annual Percentage Yield3.

Accounting & Bookkeeping

Powerful accounting software that makes it easy to keep your books up to date.

Instantly categorize transactions to streamline your bookkeeping. Access auto-generated financial reports including expense, profit & loss and cash flow statements, and gain access to insights that provide you with an in-depth understanding of the financial status of your business2.

Choose the plan that works for your business

Lili Premium

Was $55/mo

40% off for 3 months

$0 Minimum Deposit | 30 Day Free Trial

Premier Priority Service

- Front-of-the-line experience with priority support and a dedicated account specialist

Business Banking

- Advanced Business Checking Account

- Lili Visa® Debit Card8 – Metal with Cashback Awards through Visa SavingsEdge

- Fee-free ATM6 withdrawals at 38K locations

- Get paid up to 2 days early

- Domestic and international wire transfers

- Fee-free Overdraft up to $2004

- 3.00% APY3 on Savings

- Grant account access to multiple teammates

Accounting Software

- Income and expenses: Organize your business transactions

- Bookkeeping automation: Predictive transaction categorization powered by Lili AI

- Receipt capture: Add receipts and notes to expenses

- Enhanced reporting: On-demand reports including profit & loss and cash flow statements

- Invoice and payments: Easily create and send unlimited invoices, track invoice status and send reminders, accept payments instantly

- Bill management: Auto-scan your bills and pay them instantly

- Sync external business bank account and credit card transactions

Tax Preparation Software

- Tax savings: Automatically allocate funds towards tax payments

- Tax deductions: Instantly sort transactions into tax categories

- Pre-filled business tax forms: 1065/1120-S/Schedule C

Lili Smart

Was $35/mo

40% off for 3 months

$0 Minimum Deposit | 30 Day Free Trial

Business Banking

- Advanced Business Checking Account

- Lili Visa® Debit Card8 with Cashback Awards through Visa SavingsEdge

- Fee-free ATM6 withdrawals at 38K locations

- Get paid up to 2 days early

- Domestic and international wire transfers

- Fee-free Overdraft up to $2004

- 3.00% APY3 on Savings

- Grant account access to multiple teammates

Accounting Software

- Income and expenses: Organize your business transactions

- Bookkeeping automation: Predictive transaction categorization powered by Lili AI

- Receipt capture: Add receipts and notes to expenses

- Enhanced reporting: On-demand reports including profit & loss and cash flow statements

- Invoice and payments: Easily create and send unlimited invoices, track invoice status and send reminders, accept payments instantly

- Bill management: Auto-scan your bills and pay them instantly

- Sync external business bank account and credit card transactions

Tax Preparation Software

- Tax savings: Automatically allocate funds towards tax payments

- Tax deductions: Instantly sort transactions into tax categories

- Pre-filled business tax forms: 1065/1120-S/Schedule C

Lili Pro

Was $15/mo

40% off for 3 months

$0 Minimum Deposit | 30 Day Free Trial

Business Banking

- Advanced Business Checking Account

- Lili Visa® Debit Card8 with Cashback Awards through Visa SavingsEdge

- Fee-free ATM6 withdrawals at 38K locations

- Get paid up to 2 days early

- Domestic and international wire transfers

- Automatic Tax Savings

- Fee-free Overdraft up to $2004

- 3.00% APY3 on Savings

Expense Management Tools & Reports

- Organize your expense transactions

into tax categories - Attach receipts to expenses, add notes

Lili Basic

$0 Minimum Deposit

Business Banking

- Business Checking Account

- Lili Visa® Debit Card8

- Fee-free ATM6 withdrawals at 38K locations

- Get paid up to 2 days early

- Domestic and international wire transfers

- Automatic Savings

customers served

deposited

Trustpilot rating

business tools

Small businesses trust Lili to simplify their business finances

Your account is safe and secure

All Lili accounts are insured up to $250,000 through our partner bank, Sunrise Banks, N.A., Member FDIC.

Receive transaction alerts in real-time, access your Lili account from mobile or desktop anytime and instantly freeze your card from your Lili account.

Your Lili business account and Lili Visa® Debit Card are protected by industry-leading encryption software and security protocols, including fraud monitoring and multi-factor authentication.