Support that fits your schedule: live help 7 days a week and round-the-clock AI assistance. Connect by app, phone, email, or online.

Banking designed for

your business

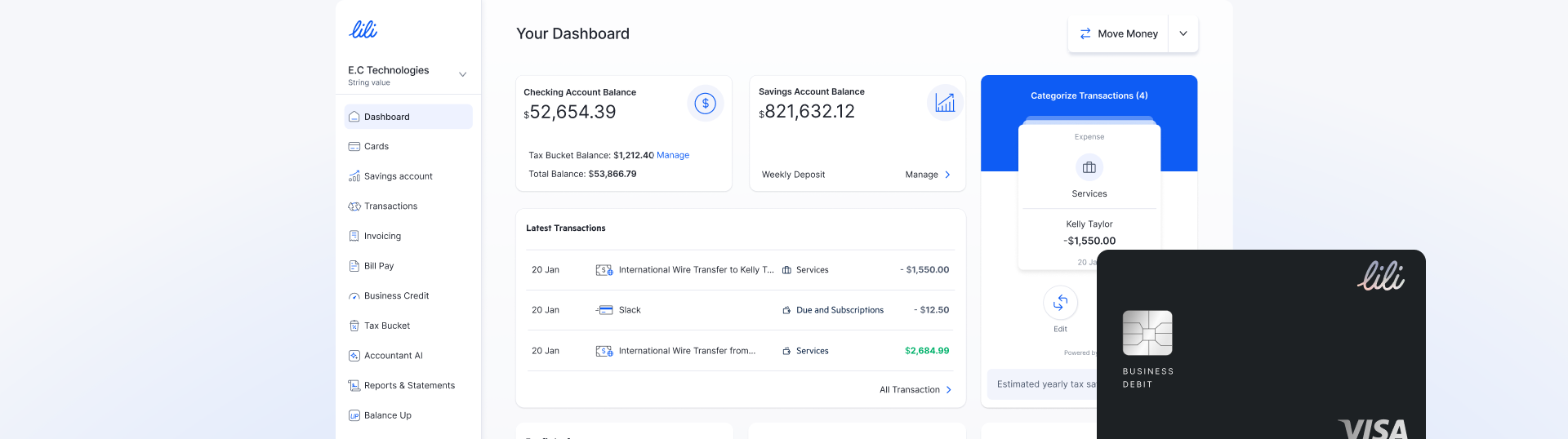

Your banking, business credit, and accounting all working seamlessly together as one so you can scale with confidence.

Banking services are provided by Sunrise Banks, N.A., Member FDIC

Which of the following are most important to you?

No Hidden Fees, No Minimum Balance8

Savings with up to 4.00% Annual Percentage Yield3

Business Credit

International Wires

Team Access

Premium Support

Banking that goes

beyond the basics.

Award-winning banking for entrepreneurs and small business owners

A business checking account with a Lili Visa® Debit Card

No hidden fees, no minimum balance

Send & receive international wires in as fast as 24 hours

Expedited ACH and check deposits5

Earn up to 4.00% APY on your business savings3

Authorize virtual and physical debit cards for your business partners

Business credit, built in.

No extra steps, no separate tools. Build and monitor your credit automatically with integrated D&B reporting, real-time alerts, and a secured card that works as you spend.*

AI-powered accounting, seamlessly synced with your banking

Keep your books accurate and up to date—transactions flow in, get instantly categorized, and appear in your reports with no extra work.

Tax-ready, year-round.

No more last-minute stress. Automate tax savings, track expenses year-round, and get pre-filled tax forms when it’s time to file.

Pay and get paid. Fast, simple, done.

Invoice clients, collect payments, pay bills, and run payroll—all from one platform. Simplify operations and stay on top of cash flow.

Your account is safe and secure

All Lili accounts are insured up to $3M through our through a network of sweep program banks.

Receive transaction alerts in real-time, access your Lili account from mobile or desktop anytime and instantly freeze your card from your Lili account.

Your Lili business account and Lili Visa® Debit Card are protected by industry-leading encryption software and security protocols, including fraud monitoring and multi-factor authentication.

thousands

Upgrade how you manage your business finances

Banking, business credit, and accounting—together in one powerful platform, built for entrepreneurs who expect more.