Connect all your essential tools, sync external credit cards, and link accounts for hassle-free management.

VIP business banking for your U.S. startup

Apply online in minutes, no SSN required

Wire transfers in as fast as 24 hours

Built-in accounting and tax automation2

Lili Premium for free for your first year (normally $660/year)

Lili is a financial technology company, not a bank.

Banking services are provided by Sunrise Banks, N.A., Member FDIC

Banking services are provided by Sunrise Banks, N.A., Member FDIC

As Featured In

The all-in-one solution that keeps your

business ahead.

Get more from your business banking.

Lili gives you and your team everything you need to move money fast, manage cash flow, and grow —without hidden fees or paperwork.

Receive international payments in as fast as 24 hours

Expedited ACH and check deposits

Earn 3.00% APY on your business savings3

Issue virtual and physical debit cards for your business partners

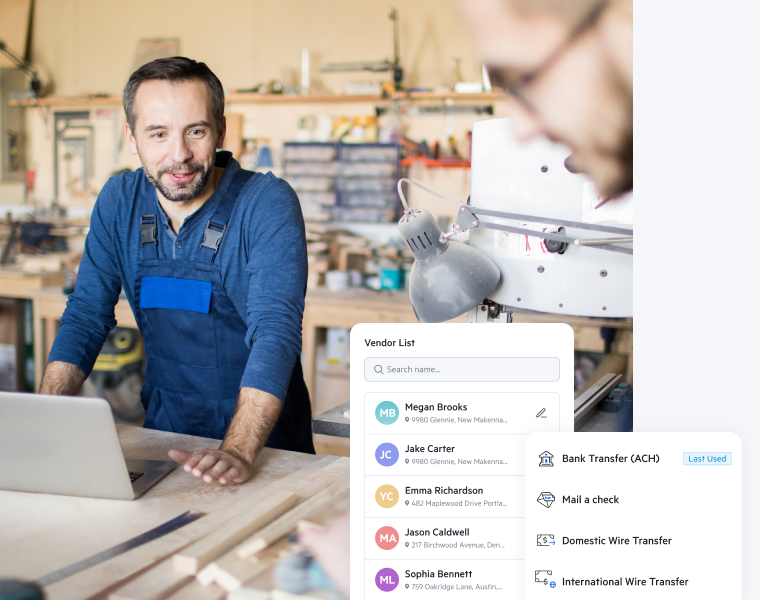

Pay and get paid. Fast, simple, done.

Manage all your business payments effortlessly—locally and internationally.2

Send invoices with multiple payment options

Pay vendors worldwide with efficient bill pay

Run payroll seamlessly with built-in integration

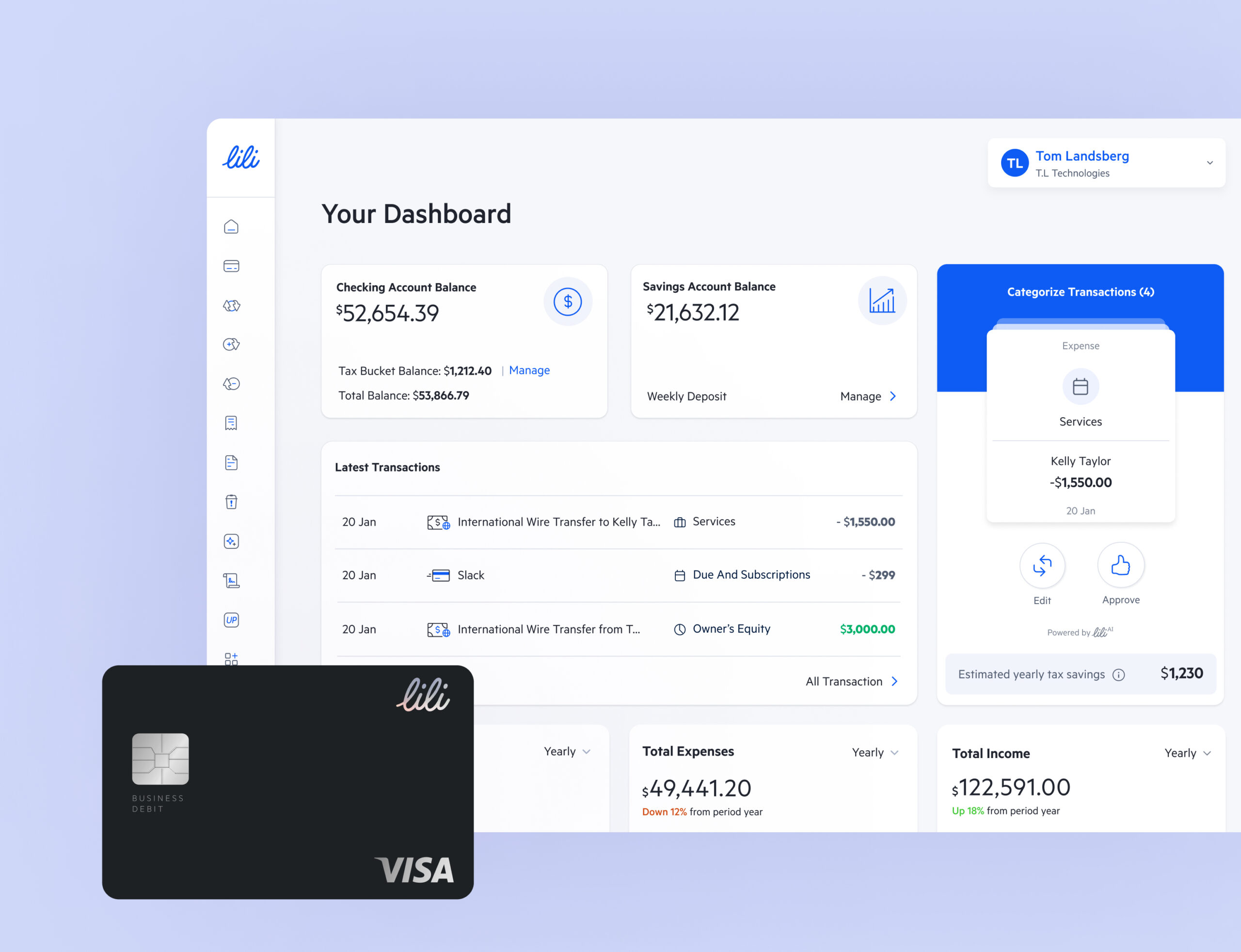

Banking & accounting. Finally in sync.

Skip the tax stress. Get a powerful accounting platform that auto-categorizes transactions, sets aside taxes, and maximizes deductions—so you keep more of what you earn.2

Automated tax savings to keep you audit-ready

One-click financial reports for total organization

AI-powered insights to drive smarter decisions

Exclusive perks for Israeli founders.

Free Lili Premium account for your first year!

Exclusive Visa® Metal Card

Priority customer service, 7 days a week

Dedicated account specialists ready to help your business scale

Your NYC office—a home base for Israeli founders

Use our NYC office space whenever you need it.

Just book ahead, and we’ll have it ready for you.

Award-winning platform.

200K+

customers served

+$2B

deposited

4.7

Trustpilot rating

25+

business tools

Seamless integrations

Smart banking for modern businesses.

Certain features are subject to your plan2.

No hidden fees

No overdraft fees

No minimum balance

100% online application

3.00% APY on savings

Role-based permissions

Gusto integration for payroll

Receipts capture

Customizable reports

AI-driven account insights

Professional invoices

Bill pay management

Traditional Banks

Top-tier security that keeps your business safe.

All Lili accounts are protected by industry-leading encryption software and security protocols, including fraud monitoring and multi-factor authentication.